- Price Board

-

AGF ALT BBC RIC TRC PTC GTA SFI IFS PTS SMC FPT UNI PNC SSC VGP STB RCL S55 S64 S99 ILC SAP SCC SGH SD3 NHC SD5 SFN TCR SGC LTC VBH TDH SD6 SD7 SHC IMP TCT SD9 SJ1 SDA SJS TMC VID RAL ITA SDC REE SDT NAV KDC VC2 MCO VSP KHA NKD VIP VFR TPH VNR TXM PPC VTL KHP PAC DCT VNC VMC NSC LAF LBM DMC PVD MEC VNM PGC VPK PJT TLT PMS MPC CYC VSH LGC VTA NBC MCP SAF SAM COM VTB SAV NPS SJE SCD TMS NST CLC SDN SFC SSI NTP CII STC PAN STP PJC PLC SVC POT TNA TBC CAN TKU BTC DHA DHG DIC TS4 TTC PSC TTP TYA VTC SDY BBS BCC BHV DTC BMI EBS BTS VTS BVS HNM HAI HJS CID HLY CJC HSC CMC HTP CTB ICF DAC DNP DPC DRC DTT BBT BMC BPC BT6 MCV MHC GMC GMD HAP HAS HAX HBC HBD HMC HRC HTV ACB DAE BMP CTN VTV GIL SGD DXP FMC GHA VFC SJD VNE TNC ACL PVI SCJ PET VIC PVS ABT TSC HDC BTH C92 CDC DCS DST HCC HCT HEV HHC KBC KMF LUT MIC PGS PVC PVE SD2 SDJ SJC TJC TNG TST VC3 VC7 VCS VDL XMC CAP S96 SJM S12 VC5 QNC SRA ANV DPM DPR HPG HSI HT1 L10 LSS NTL PVT SC5 SGT ST8 TCM TPC UIC VHC VSC VTO ASP VHG VPL SBT DQC DXV PIT TTF BLF B82 CSG DBC HUT KMR L18 L43 L62 LBE NGC ONE SD4 SDD SRB TC6 VC6 VE9 VKP YBC CTC DDM SDS TV4 CNT VNS KKC VCG VE1 DCL VSG CCM THT SZL VNA STL SPP TPP L61 TBX THB OPC SSM TRA KSH DC4 HLA LCG NBB MKV TDN SD8 DHT HSG HAG PVA VGS SVI PVG V11 BST TIE CAD PNJ VCC QTC MTG SEB D2D VHL QST VST HLC HT2 SDP SHB ICG HCM VC1 HVT BHC DZM ECI TMP VCB BVH SHS DHC S74 APS TGP CFC VDS DDN HIG PPP SME MDC HOM ABI AAM CTG NBP CTS KMT EID CSM VNL DNT PHR VNT SED BKC DIG PVX DAD RDP MAS ATA BTP VPH HLG NAG TCO VNI TNM VC9 DC2 CMG VMG MCG SDU SRF VNG SRC HDO PDC VPC EFI VDP PMC LGL ITC BED TV2 TIX GGG GTH API TMX CMI HAD DBT SDH GDT ACE CT3 EIB PSP CSC VIT ITD PHC IME CVT MSN V12 BXH TH1 ACC AGR BMJ CDG CKV CTD DAG DBM DID DNC DVP GLT HGM HVG LHC LIX LM3 LO5 MAC MHL PGD PGT PTG PTP SDG SHN SQC TKC TMW TV3 UDJ V15 VFG VIG VNX WSS TCL L44 DXG KSB VQC AMV SHI IHK VIX DGT ASM BDB FDC SNC CAT HDM NT2 TEC KBE TAG LHG INN CPC TTG TVG VKD TMT BTW VHF HDG CH5 CMT KDH VT1 ADP VDN H22 APC CTT GEC CTI TLG HPT TBT DL1 L35 PSB MLG HFC VBC NBW SDB PTH PHH IMT PSL CCH DSG NDC DNS SSF STG DTV BTT ICI QHD BTG HPB SPD STS TLH TNB SDE DC1 VEE VIA GDW BWA VND LCC CX8 TVP VNH APG CHP IN4 MCC CCI CT6 HTC LIG DLT VES IJC PPI DAP PVL DXL HMG POM OGC ICL STV V21 TET DPP NNT PDN PEQ SBA TDC VXB WEB DCD MDF VIR KPC KSD PTT DLR HAT MJC DNY HU1 NVT RBC VCR HPA SPM VCM HU6 SBS MKP WTC NTB KHB SPC TNT IDV INC AME GER SMT PXT PXS NNC DTL PVR PHS HVC PXI PXM VE3 BVG GTT TIP CMV DTA DLG BCE CC7 NCS VHH DHD LDP UDC LCS NHA HCI VCT ORS PMT HBS VE2 AAA HCB VNF HFX MCS DRH NET SMB PSI WCS WSB HHG SD1 ND2 SGS VLA VRC HMH PCT STU HTG PDR HPP QCG C32 VCP NTS SCO CVN S27 CLG PIV TMD MIM SCL ALV NVB TDL CDN SDK VOS MTH VMD MTP PEC DLD HVX IDJ POV PVV SHP ARM TV1 DSN VTI PTL BVN TDW SMA OCH QCC LAS HTL CLW KTB CTA KAC KST BCP APP PFL LM7 PX1 TIG LCD ELC KTT HQC NOS PTD HLB NMK UPC BSC HBB SCR CMX FDG BHT HSM LM8 PRC VAT AVF BRC KCE VDT MDG PXL MCJ VKC DNM VCA CMS DAS VSI EVE GHC KLM VLF PV2 HTI AUM STT MEF HDA PTI SWC H11 ADC KCB SDV SSG TVD DTH PCG TIS KTS PNT D11 PIC PPS TSB HTS NKG FBA REN MCF CCL VCF PSG DIH VMA PXA PTB HU3 LMR HKP VIE C47 NDN PJS GSC IDI CI5 HOT THG TDS C21 JVC BGM BIC DNL KAL VTE SDI PGI VIM EIC IFC PVH BIO BSI CIG CVBS HBBS KEVS MSBS SASC SVN IVS MTV L14 GMX LCM TTN PPE SVT FLC MBB SAB HAB DVB CNG HHS AMC KHL GSP ASA NTW DRL GAS CTX MED ATC BHP BT1 CHC CMK DOP GCC HAL HQM ITQ MTC PXC STJ TVM UEM V45 VCN XMD LKW DHM SPI HU4 FCN VE8 BID SII CBVS FPTS MBSC TVSI SEAS VPBS VE4 PSE AGM PID SLS PTK TTZ SHA DHP HLD HAR NLG CQN FCM MWG PSD FIT NDX KSQ TVI HPI TVN THA VLD KLF SSN CLL PVP THS DVC PVB GLSC KSK NFC DTN PEN VCX VIN SPH VTX ABC QPH CEC CEO CNC KSG SCI AMD TA9 SKG DGC TVC BII QBS ASD NDF PRO VMI SFG CAV PTE VTH XPH E1VFVN30 TBD CK8 VRG TVS KTL CKG NCT GTC MFS TL4 VTJ HAH TTB CSV FID PBP RCD GSM MTM CDO G20 NHP NNG HKB DP3 KVC SHG DCM VT8 SAS SMN VAF DPS HVA CNH CKD SGR HHA ICN PDB MBG KPF DDV HPD ACM PCE TVB PMP ISH TNI TOP VPS BCG SDX MTA NQB C71 PSW PVO VGT LAI AGX DNW HNG ISG VLG VIETJET SGN BDW BFC DGW DAT LDG HVN SVG PHP MCI TRS VNP AGP VTG HJC CCR STK PMB MSR NAF VGC VMS HNB GEX VLC HNF NPH TPS TFC BLI SGO PCN HHV ITS LAW TEG VEF VSA VTM NDP PIS MPT HPM CMP CXH TND THW VPA PPY VGG BTU BMN MBS KDM ATS NWT TDM PNG I10 KIP VPD BDG CLM SGP BEL BWS CLH CPH CTP CTW DFC DNR DT4 FCC HAN HD2 HID HLR ICC LQN MGC MST MTL MVB NAP NCP NSG PYU RAT S4A CNN NBT DBH IPA CDH ADS PMJ DDH HCD VNB KSV NLS TAW CQT BSP VGL NBR ATG BTR ROS TAP BLN YRC HRT APL CCT CMF GKM HHN HKT HNT HTR IBC LEC MC3 MLS NNB QBR QNW SAC SPB SRT VCE VLB VPR VSM VTP XHC VOC QSP EAD SP2 TCH HND L63 DAH TTV SHX HAC TW3 L45 GTS VSN TTH BHN RTS CTF ACV AFX RTB DND TVU NTR ANT BSG DOC DSV DTK GGS GTD HNP HTT HTW LCW NS2 PC1 PHN POS PSN PVM RLC SAL SBD SZE TMG UCT VCW VWS C69 CET HPW HTU RCC NQT CVC HES MES NVP NTC SSU QNS HEC KHD QHW SEA TNP C12 G36 NS3 SB1 NVL GCB SPA UPH TB8 CCV SID HEM L12 MCT IST MCH BDF PKR TNS DBW VIB HGW AMP BTB CHS CKH DCF DPG GVT VIF FTS FOX DBD TMB X18 DPH HSA PAI SBL BRS FTM AMS FSO SEP TTD USC AC4 TQN TSD SPV MVY NAS EMG HHR ONW X77 KHW NUE PND GND TUG PIA VJC BSQ DTG QNU CLX RTH BTD BTV FCS BAX MH3 DCI CCP EIN HDP QTP RHN TRT GEG NAC MVC VBG PCF HFB QLT DNE CE1 CMW TVA THR TSG PDV PLX HCS DSS VIH BDP MTS MIG SBV MPY BSD DAR CEG DP2 DVN DRI MLC SIV TCD TNW TTS C36 TTT HMS LIC BMV THU EVG TDG AFC APF BMD NHV BRR BSL DNH RGC CBS CVH PTO TTJ CGV HII VHD CDR TCW KLB PWS SJF VCI BLT CMN HC3 SCS ACS HEJ VEC TVT DNN EME TOT VGV VLW VLP TDB BWE CC1 LMI HAF HTE LTG DHB VAV CC4 CPI JOS NSH TSJ ART BHA YTC NAW HBH PCM KSE MND LBC LLM VPB NED PLP DS3 HAM NBE PPH SVL ATB UMC BDT NHH KGM LMC SBM TEL MEL CIP FT1 CBI KDF POB HNA LPB THN HLS VVN DNA FBC FUESSV50 SCY SKH FTI TCK BGW CTR HDW SKV VRE HRB MGG T12 MQB VPW HLE PCC DTD WTN PBK PLA SNZ FRM IDC TCJ VPI ILA TA6 CIA HAV CAG TLD KOS TLP TVW HNI MRF VET HEP MIE HUG LG9 NHT BPW EPH LWS KHS NTT BAB HPH SVH FHN PVY AST BBM BTN DSC DTI EMS HDB QLD SON SUM TA3 VIW AVC GLW HPU IKH BQB AG1 M10 MDA BAL HFS HFT TTL VPG TS3 TS5 IRC PMG X20 SJG BCM KTU BSR POW OIL LDW ILS GVR PGV BUD BHK NRC VGR BMF DHN TPB DCH VSF MNB VDM FRT HTM PRT HSL VHM S72 XLV C22 TGG TCB DVW SBH HNR ABR DP1 CEN NQN KTC MQN AAV YEG NAU VEA BSH DX2 STW X26 CDP HBW TDT HPX FRC HIZ HWS PTX EVS FIC VNY EVF BMS HHP BSA CRC YBM CRE TCI NDT HTK BDC FGL VGI EPC MBN DCR MVN DKP SKN VSE LMH CKA DM7 DSP FIR BLW XDH A32 BCB BHG NSS FHS PEG HTN TDP MDN PDT VDB MSH HVH C4G FOC TTE TID DCG DDG VTK BMG BNW GLC VHE SZC TVH PBT BLU BOT DWS HUB SHE TAR TLI TOW USD CSI HD8 ILB PNP AQN IBD TN1 CFV SIP APT BXT MHY TAN NDW PWA HD3 TQW NTH DNB BKH IPH LNC NTF PGN ATD CMD SOV GAB BM9 PMW DTB NSL VBB CAM VXP CAB MEG CPW VTR PQN SIG DFS E29 PTV VTD THP CBC PBC MML DRG LGM SZB ADG CCA HLT CPA E12 MDT HC1 DUS GTK VHI AGG GQN QNT UDL CT5 ICT HGA HNE NNQ HGC BCF STH ABS FUESSVFL DKH HSP PLO VW3 DXD FUEVFVND TDF BBH VXT HKC TKA DTP THD PSH VFS MA1 HAW HGR SCA BVB DKC FUEVN100 AAS APH FUESSV30 TR1 HUX TTA PAS ASG NAB BNA HGT SGB SBR GIC MHP HD6 GMA CGL FUEMAV30 MTB MXC MCM MSB PGB PRE ABB BKG DTE TNH IDP NJC PLE AIC DVG DPD CFM L40 OCB SVD BCV AAT SSB LPT TKG SCG CST HSV GE2 IBN LYF SCV VTQ TV6 BVL DFF PAP DXS KHG VAB HTH ACG GH3 SSH TOS TBH XMP BCA SGI KSF FUEIP100 FUCTVGF3 DMN VTZ BAF CNA NXT DAN DWC SZG TIN FUEKIV30 BIG ODE GMH HMR VUA GEE MGR CVP TED LSG DSD PAT PPT CAR DVM TBR PCH AGE FUEDCMID VVS PTN MCD CMM FUEKIVFS NO1 XDC GCF TDI VNZ DLM GPC VMT FUEMAVND FUEFCV50 ABW DMS BHI FUEBFVND GDA THM HIO NCG SBG BCO BCR SBB NEM D17 KTW TAL TBW AAH VMK QNP FUEKIVND HDS

- |

- EN

-

AGF ALT BBC RIC TRC PTC GTA SFI IFS PTS SMC FPT UNI PNC SSC VGP STB RCL S55 S64 S99 ILC SAP SCC SGH SD3 NHC SD5 SFN TCR SGC LTC VBH TDH SD6 SD7 SHC IMP TCT SD9 SJ1 SDA SJS TMC VID RAL ITA SDC REE SDT NAV KDC VC2 MCO VSP KHA NKD VIP VFR TPH VNR TXM PPC VTL KHP PAC DCT VNC VMC NSC LAF LBM DMC PVD MEC VNM PGC VPK PJT TLT PMS MPC CYC VSH LGC VTA NBC MCP SAF SAM COM VTB SAV NPS SJE SCD TMS NST CLC SDN SFC SSI NTP CII STC PAN STP PJC PLC SVC POT TNA TBC CAN TKU BTC DHA DHG DIC TS4 TTC PSC TTP TYA VTC SDY BBS BCC BHV DTC BMI EBS BTS VTS BVS HNM HAI HJS CID HLY CJC HSC CMC HTP CTB ICF DAC DNP DPC DRC DTT BBT BMC BPC BT6 MCV MHC GMC GMD HAP HAS HAX HBC HBD HMC HRC HTV ACB DAE BMP CTN VTV GIL SGD DXP FMC GHA VFC SJD VNE TNC ACL PVI SCJ PET VIC PVS ABT TSC HDC BTH C92 CDC DCS DST HCC HCT HEV HHC KBC KMF LUT MIC PGS PVC PVE SD2 SDJ SJC TJC TNG TST VC3 VC7 VCS VDL XMC CAP S96 SJM S12 VC5 QNC SRA ANV DPM DPR HPG HSI HT1 L10 LSS NTL PVT SC5 SGT ST8 TCM TPC UIC VHC VSC VTO ASP VHG VPL SBT DQC DXV PIT TTF BLF B82 CSG DBC HUT KMR L18 L43 L62 LBE NGC ONE SD4 SDD SRB TC6 VC6 VE9 VKP YBC CTC DDM SDS TV4 CNT VNS KKC VCG VE1 DCL VSG CCM THT SZL VNA STL SPP TPP L61 TBX THB OPC SSM TRA KSH DC4 HLA LCG NBB MKV TDN SD8 DHT HSG HAG PVA VGS SVI PVG V11 BST TIE CAD PNJ VCC QTC MTG SEB D2D VHL QST VST HLC HT2 SDP SHB ICG HCM VC1 HVT BHC DZM ECI TMP VCB BVH SHS DHC S74 APS TGP CFC VDS DDN HIG PPP SME MDC HOM ABI AAM CTG NBP CTS KMT EID CSM VNL DNT PHR VNT SED BKC DIG PVX DAD RDP MAS ATA BTP VPH HLG NAG TCO VNI TNM VC9 DC2 CMG VMG MCG SDU SRF VNG SRC HDO PDC VPC EFI VDP PMC LGL ITC BED TV2 TIX GGG GTH API TMX CMI HAD DBT SDH GDT ACE CT3 EIB PSP CSC VIT ITD PHC IME CVT MSN V12 BXH TH1 ACC AGR BMJ CDG CKV CTD DAG DBM DID DNC DVP GLT HGM HVG LHC LIX LM3 LO5 MAC MHL PGD PGT PTG PTP SDG SHN SQC TKC TMW TV3 UDJ V15 VFG VIG VNX WSS TCL L44 DXG KSB VQC AMV SHI IHK VIX DGT ASM BDB FDC SNC CAT HDM NT2 TEC KBE TAG LHG INN CPC TTG TVG VKD TMT BTW VHF HDG CH5 CMT KDH VT1 ADP VDN H22 APC CTT GEC CTI TLG HPT TBT DL1 L35 PSB MLG HFC VBC NBW SDB PTH PHH IMT PSL CCH DSG NDC DNS SSF STG DTV BTT ICI QHD BTG HPB SPD STS TLH TNB SDE DC1 VEE VIA GDW BWA VND LCC CX8 TVP VNH APG CHP IN4 MCC CCI CT6 HTC LIG DLT VES IJC PPI DAP PVL DXL HMG POM OGC ICL STV V21 TET DPP NNT PDN PEQ SBA TDC VXB WEB DCD MDF VIR KPC KSD PTT DLR HAT MJC DNY HU1 NVT RBC VCR HPA SPM VCM HU6 SBS MKP WTC NTB KHB SPC TNT IDV INC AME GER SMT PXT PXS NNC DTL PVR PHS HVC PXI PXM VE3 BVG GTT TIP CMV DTA DLG BCE CC7 NCS VHH DHD LDP UDC LCS NHA HCI VCT ORS PMT HBS VE2 AAA HCB VNF HFX MCS DRH NET SMB PSI WCS WSB HHG SD1 ND2 SGS VLA VRC HMH PCT STU HTG PDR HPP QCG C32 VCP NTS SCO CVN S27 CLG PIV TMD MIM SCL ALV NVB TDL CDN SDK VOS MTH VMD MTP PEC DLD HVX IDJ POV PVV SHP ARM TV1 DSN VTI PTL BVN TDW SMA OCH QCC LAS HTL CLW KTB CTA KAC KST BCP APP PFL LM7 PX1 TIG LCD ELC KTT HQC NOS PTD HLB NMK UPC BSC HBB SCR CMX FDG BHT HSM LM8 PRC VAT AVF BRC KCE VDT MDG PXL MCJ VKC DNM VCA CMS DAS VSI EVE GHC KLM VLF PV2 HTI AUM STT MEF HDA PTI SWC H11 ADC KCB SDV SSG TVD DTH PCG TIS KTS PNT D11 PIC PPS TSB HTS NKG FBA REN MCF CCL VCF PSG DIH VMA PXA PTB HU3 LMR HKP VIE C47 NDN PJS GSC IDI CI5 HOT THG TDS C21 JVC BGM BIC DNL KAL VTE SDI PGI VIM EIC IFC PVH BIO BSI CIG CVBS HBBS KEVS MSBS SASC SVN IVS MTV L14 GMX LCM TTN PPE SVT FLC MBB SAB HAB DVB CNG HHS AMC KHL GSP ASA NTW DRL GAS CTX MED ATC BHP BT1 CHC CMK DOP GCC HAL HQM ITQ MTC PXC STJ TVM UEM V45 VCN XMD LKW DHM SPI HU4 FCN VE8 BID SII CBVS FPTS MBSC TVSI SEAS VPBS VE4 PSE AGM PID SLS PTK TTZ SHA DHP HLD HAR NLG CQN FCM MWG PSD FIT NDX KSQ TVI HPI TVN THA VLD KLF SSN CLL PVP THS DVC PVB GLSC KSK NFC DTN PEN VCX VIN SPH VTX ABC QPH CEC CEO CNC KSG SCI AMD TA9 SKG DGC TVC BII QBS ASD NDF PRO VMI SFG CAV PTE VTH XPH E1VFVN30 TBD CK8 VRG TVS KTL CKG NCT GTC MFS TL4 VTJ HAH TTB CSV FID PBP RCD GSM MTM CDO G20 NHP NNG HKB DP3 KVC SHG DCM VT8 SAS SMN VAF DPS HVA CNH CKD SGR HHA ICN PDB MBG KPF DDV HPD ACM PCE TVB PMP ISH TNI TOP VPS BCG SDX MTA NQB C71 PSW PVO VGT LAI AGX DNW HNG ISG VLG VIETJET SGN BDW BFC DGW DAT LDG HVN SVG PHP MCI TRS VNP AGP VTG HJC CCR STK PMB MSR NAF VGC VMS HNB GEX VLC HNF NPH TPS TFC BLI SGO PCN HHV ITS LAW TEG VEF VSA VTM NDP PIS MPT HPM CMP CXH TND THW VPA PPY VGG BTU BMN MBS KDM ATS NWT TDM PNG I10 KIP VPD BDG CLM SGP BEL BWS CLH CPH CTP CTW DFC DNR DT4 FCC HAN HD2 HID HLR ICC LQN MGC MST MTL MVB NAP NCP NSG PYU RAT S4A CNN NBT DBH IPA CDH ADS PMJ DDH HCD VNB KSV NLS TAW CQT BSP VGL NBR ATG BTR ROS TAP BLN YRC HRT APL CCT CMF GKM HHN HKT HNT HTR IBC LEC MC3 MLS NNB QBR QNW SAC SPB SRT VCE VLB VPR VSM VTP XHC VOC QSP EAD SP2 TCH HND L63 DAH TTV SHX HAC TW3 L45 GTS VSN TTH BHN RTS CTF ACV AFX RTB DND TVU NTR ANT BSG DOC DSV DTK GGS GTD HNP HTT HTW LCW NS2 PC1 PHN POS PSN PVM RLC SAL SBD SZE TMG UCT VCW VWS C69 CET HPW HTU RCC NQT CVC HES MES NVP NTC SSU QNS HEC KHD QHW SEA TNP C12 G36 NS3 SB1 NVL GCB SPA UPH TB8 CCV SID HEM L12 MCT IST MCH BDF PKR TNS DBW VIB HGW AMP BTB CHS CKH DCF DPG GVT VIF FTS FOX DBD TMB X18 DPH HSA PAI SBL BRS FTM AMS FSO SEP TTD USC AC4 TQN TSD SPV MVY NAS EMG HHR ONW X77 KHW NUE PND GND TUG PIA VJC BSQ DTG QNU CLX RTH BTD BTV FCS BAX MH3 DCI CCP EIN HDP QTP RHN TRT GEG NAC MVC VBG PCF HFB QLT DNE CE1 CMW TVA THR TSG PDV PLX HCS DSS VIH BDP MTS MIG SBV MPY BSD DAR CEG DP2 DVN DRI MLC SIV TCD TNW TTS C36 TTT HMS LIC BMV THU EVG TDG AFC APF BMD NHV BRR BSL DNH RGC CBS CVH PTO TTJ CGV HII VHD CDR TCW KLB PWS SJF VCI BLT CMN HC3 SCS ACS HEJ VEC TVT DNN EME TOT VGV VLW VLP TDB BWE CC1 LMI HAF HTE LTG DHB VAV CC4 CPI JOS NSH TSJ ART BHA YTC NAW HBH PCM KSE MND LBC LLM VPB NED PLP DS3 HAM NBE PPH SVL ATB UMC BDT NHH KGM LMC SBM TEL MEL CIP FT1 CBI KDF POB HNA LPB THN HLS VVN DNA FBC FUESSV50 SCY SKH FTI TCK BGW CTR HDW SKV VRE HRB MGG T12 MQB VPW HLE PCC DTD WTN PBK PLA SNZ FRM IDC TCJ VPI ILA TA6 CIA HAV CAG TLD KOS TLP TVW HNI MRF VET HEP MIE HUG LG9 NHT BPW EPH LWS KHS NTT BAB HPH SVH FHN PVY AST BBM BTN DSC DTI EMS HDB QLD SON SUM TA3 VIW AVC GLW HPU IKH BQB AG1 M10 MDA BAL HFS HFT TTL VPG TS3 TS5 IRC PMG X20 SJG BCM KTU BSR POW OIL LDW ILS GVR PGV BUD BHK NRC VGR BMF DHN TPB DCH VSF MNB VDM FRT HTM PRT HSL VHM S72 XLV C22 TGG TCB DVW SBH HNR ABR DP1 CEN NQN KTC MQN AAV YEG NAU VEA BSH DX2 STW X26 CDP HBW TDT HPX FRC HIZ HWS PTX EVS FIC VNY EVF BMS HHP BSA CRC YBM CRE TCI NDT HTK BDC FGL VGI EPC MBN DCR MVN DKP SKN VSE LMH CKA DM7 DSP FIR BLW XDH A32 BCB BHG NSS FHS PEG HTN TDP MDN PDT VDB MSH HVH C4G FOC TTE TID DCG DDG VTK BMG BNW GLC VHE SZC TVH PBT BLU BOT DWS HUB SHE TAR TLI TOW USD CSI HD8 ILB PNP AQN IBD TN1 CFV SIP APT BXT MHY TAN NDW PWA HD3 TQW NTH DNB BKH IPH LNC NTF PGN ATD CMD SOV GAB BM9 PMW DTB NSL VBB CAM VXP CAB MEG CPW VTR PQN SIG DFS E29 PTV VTD THP CBC PBC MML DRG LGM SZB ADG CCA HLT CPA E12 MDT HC1 DUS GTK VHI AGG GQN QNT UDL CT5 ICT HGA HNE NNQ HGC BCF STH ABS FUESSVFL DKH HSP PLO VW3 DXD FUEVFVND TDF BBH VXT HKC TKA DTP THD PSH VFS MA1 HAW HGR SCA BVB DKC FUEVN100 AAS APH FUESSV30 TR1 HUX TTA PAS ASG NAB BNA HGT SGB SBR GIC MHP HD6 GMA CGL FUEMAV30 MTB MXC MCM MSB PGB PRE ABB BKG DTE TNH IDP NJC PLE AIC DVG DPD CFM L40 OCB SVD BCV AAT SSB LPT TKG SCG CST HSV GE2 IBN LYF SCV VTQ TV6 BVL DFF PAP DXS KHG VAB HTH ACG GH3 SSH TOS TBH XMP BCA SGI KSF FUEIP100 FUCTVGF3 DMN VTZ BAF CNA NXT DAN DWC SZG TIN FUEKIV30 BIG ODE GMH HMR VUA GEE MGR CVP TED LSG DSD PAT PPT CAR DVM TBR PCH AGE FUEDCMID VVS PTN MCD CMM FUEKIVFS NO1 XDC GCF TDI VNZ DLM GPC VMT FUEMAVND FUEFCV50 ABW DMS BHI FUEBFVND GDA THM HIO NCG SBG BCO BCR SBB NEM D17 KTW TAL TBW AAH VMK QNP FUEKIVND HDS

- Open Account

- Login

- BSC Introduction

- Analysis Report

- New Products

- Help Center

- Derivatives

- Price Board

FUTURES CONTRACTS (FC)

What is the FC? A futures contract is a asset purchase agreement in the present and delivered at a specified date in the future.

Underlying assets: can be anything, usually commodities and financial instruments:

- Stocks, stock indices

- Bonds and interest rate instruments in the currency market

- Foreign currency

-

Agricultural goods, metals, energy,

Terms of the Contract

The FC is only traded on the Derivatives Exchange, not on the OTC market. The Derivatives Exchange regulates and standardizes the terms of a contract, including:

- Underlying asset class

- Contract size (multiplier)

- Time of maturity

- Trading principles

- Payment method

Trading mechanism:

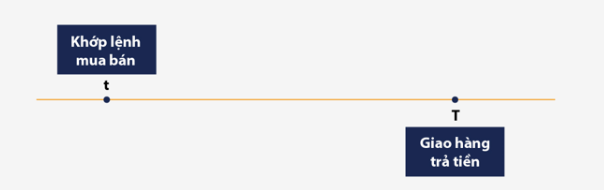

Order execution Buy/Sell orders of the same type of futures contracts are put into order execution in a continuous, periodic or agreed auction method (as in the underlying market). When executing the buy/sell price and the volume of the goods are determined. Since the delivery and payment will be made in the future and the transaction is just a commitment to buy/sell, the buyer does not need to have the money ready and the seller does not need to have the goods before the transaction.

Margin To ensure that when maturity, the contractual obligations must be made, i.e. the seller deliveres the assets and the buyer pays the money, both parties must make a deposit before the transaction.

The margin amount is transferred in advance to the margin account at the Clearing Member of the Clearing House (CCP). The minimum margin requirement before the transaction is called the Initial Margin, and is calculated as a percentage of the value to be traded.

Delivery is made in the future, immediately after the contract expires. There are two modes of delivery: money transfer or material transfer.

- For the form of money transfer: the seller and the buyer will pay each other the difference between the contract price and the final payment price of the contract. The final payment price is usually determined by the price in the spot market on the contract maturity date.

- For the form of material transfer: the seller will deliver the underlying goods, the buyer delivers the money.

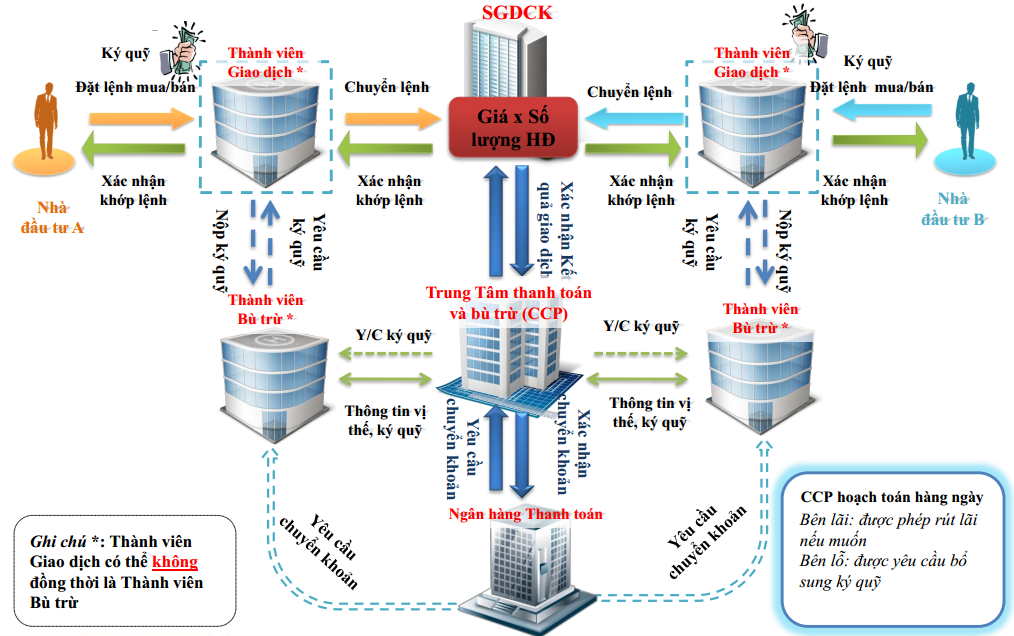

Market structure

The Stock Exchange provides an order matching trading system and sets out the terms of the CONTRACT.

The Clearing House (CCP) manages trading positions, receives and manages margins from clearing Members and ensures that the trading parties fulfill their payment obligations.

The Payment Bank performs the function of receiving and making payments for transactions in the derivatives market as required by the CCP.

The trading member receives an order from the buyer/seller, then transfers the order to the Exchange and notifies the trading results to the Investors.

The clearing member receives the margin from the buyer/seller, after which the margin will be transferred to the Clearing House (CCP).

The investor places a trading order at the Trading Member and submits the margin at the Clearing Member. Normally, The securities companies will be both trading members and clearing members.

Valuation of THE Contract

The trading price of the CONTRACT is determined by the supply and demand of the asset generated by the orders of buyers and sellers in the market. Orders are matched through continuous auctions on the Exchange.

However, it should be noted not to set the price too far from the fair value of the contract, since the transaction price is often pulled back to fair value.

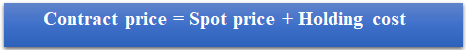

The price of the contract is determined according to the principle of cost balance, in which the price of the CONTRACT will be equal to the spot price plus the cost of holding from the present to the time in the future.

Specifically, at the time of t, the seller, if the delivery is made immediately, will be entitled to the St price (Spot Price). If the seller holds the goods to the time of T in the future for delivery to the buyer, it is subject to the additional cost of keeping goods C from the time of t to the time of T (Holding Cost). Therefore, the seller should sign the delivery contract around the fair value Ft as follows: Ft = St + C(t, T).

INDEX FUTURES CONTRACTSA type of futures contract whose underlying assets/instruments are a stock index. Similar to other types of futures contracts, stock index futures contracts are instruments traded on a centralized exchange with standardized terms.

Some stock index futures contracts around the world

| Tool name | Exchange |

| S&P 500 index futures Contract | Chicago Mercentile Exchange - CME (USA) |

| DAX Index Futures Contract | Eurex Derivatives Exchange (Germany) |

| Nikkei 225 index futures Contract | Osaka Derivatives Exchange - OSE (Japan) |

| KOSPI 200 index futures contract | Korea Stock Exchange - KRX |

| ASX SPI 200 index futures contract | Australian Stock Exchange - ASX |

| VN30 Index Futures Contract | Hanoi Stock Exchange - HNX |

For example, the Futures Contract on VN30 Index:

|

VN30 Index Futures Contract |

|

|

Underlying assets |

VN30 Index |

|

List price |

900 index points |

|

Price step |

0.1 index point |

|

100,000 VND |

|

Maturity month |

July 2018 |

|

Payment method |

|

The contract multiplier is the value corresponding to 1 point of the index.

The contract size is the value of the contract that is calculated as (Base Index Point x Contract Multiplier Coefficient).

Valuation is determined according to the principle of cost balance.

In it:

S: base price

e: constant = 2.71

r: loan interest rate

d: average dividend yield of the index

T: holding time to maturity

The contract maturityThe HNX Exchange stipulates that the maturity months of the index contract are the nearest month, the next month and the last month of the next 2 quarters. The due date is the third Thursday of the month of maturity.

Cash payment methodOn the maturity date of the contract, if the position remains open, the seller will receive a daily payment chain in cash with a total value equal to the difference between the contract price and the final payment price.

The final payment price is regulated by the Clearing House, which will normally be determined from the base index price on the last trading day.After the last trading day, the corresponding CONTRACT will be delisted. The positions of this contract on the investor account will no longer be available.

- EXAMPLES

VN30 Index Futures Contract

|

Asset |

VN30 Index Futures Contract |

|

Ticker |

VN30F1808 |

|

Exchange |

HNX |

|

Base index |

VN30 Index |

|

List price |

950 index points |

|

Price step |

0.1 index point |

|

Contract multiplier |

100,000 VND |

|

Maturity month |

August 2018 |

|

Payment method |

Cash |

Transactions

|

Derivatives Exchange |

HNX |

|

Product |

VN30 August Futures Contract |

|

Open a short position |

Sold 10 August Futures contract, priced at 950 |

|

Close position |

Buy 10 August Futures contract, price 930 |

Position

|

Initial |

0 |

|

Short 10 contracts in July |

- 10 contracts (short position) |

|

Cover 10 contracts in July |

+10 contracts (closed position) |

|

Final position |

0 |

Margin account

|

Initial margin ratio |

14% |

|

Initial margin amount |

133,000,000 VND |

|

Difference (selling price – buying price) |

(950 - 930) = 20 (index points) |

|

Contract multiplier |

100,000 VND |

|

Profit for the transaction of 1 contract |

20*100,000 = 2,000,000 (VND/contract) |

|

Profit for the transaction of 10 contracts |

10*2,000,000 = 20,000,000 (VND) |

|

The final total amount on the account |

133,000,000 + 20,000,000 = 153,000,000 (VND) |

Profit margin (PM%)

|

PM% of margin account |

20,000,000/133,000,000 = 15% |

|

PM% of the index |

20/950 = 2.1% |

|

Leverage factor |

15%/2.1% = 7.1 (times) |